Learn

about

sustainability

Discover

your

preferences

Explore

sustainable

investments

Enhance

your

investments

Check

your

portfolio

Take action

with

awareness

Protect

biodiversity

biodiversity

How Can I Take Action?

Biodiversity can be defined as the wealth of life on earth: the millions of plants, animals and microorganisms, the genes they contain, and the complex ecosystems they make up in the biosphere.

Biodiversity is assessed by theabundance and interactions among the different forms of life that inhabit our Planet. Diversity at the genetic, species and ecosystem levels is usually studied.

Preserving biodiversity means monitoring and taking action to preserve and strengthen natural ecosystems to ensure that they function properly so that nature continues to provide us with food and water, and continues to act as a barrier to the spread of pathogens and reduce the concentration of CO2 in the atmosphere.

Human activities are the main contributors, directly or indirectly, to the degradation of biodiversity, and sustainability goals aim to restore a balance throughvoluntary action to protect ecosystems and endangered animal and plant species

Common fund goals can be combined with climate goals (acting on forests to curb CO2 emissions), or focused on innovative development plans for sustainable agriculture or in other forms of projects related to the development of qualitative forms of coexistence between humans and nature.

Sustainable investors use several management strategies :

The Exclusion Approach: Many funds approach the issue by excluding Society that do harm to the environment, such as through unsustainable agricultural or real estate practices, or that are causing deforestation of primary forests.

The Thematic Approach: some funds invest exclusively in Society and in projects that have biodiversity at the heart of their economic activities (research, agriculture, forest management). Sometimes biodiversity is part of the activities of so-called thematic funds dedicated to climate or the environment. Rarely does it become part of activities of generalist funds.

The Normative Approach: funds make particular reference to the work of the UN, the UN Convention on Biodiversity, and the Sustainable Development Goals, particularly the Earth and Water Life Actions, and the Genetically Modified Organisms conventions. Nonprofit institutions and academics continuously monitor the situation and provide support and analysis on the ground.

Best practices-impact investing: impact funds have developed evolved systems for monitoring results and work with researchers, academics, and entrepreneurs to implement innovative, high-impact projects.

We use about 100 criteria to calculate the importance of the biodiversity issue in the activities of mutual funds in our universe.

At the level of ESG Screening, we see a large number of exclusion strategies (commodity extraction, deforestation, fur, GMOs), particularly among generalist funds and ETFs. Several Society have developed a management policy that takes into accountESG Risk related to biodiversity, and act accordingly. Others also take into account theImpact they go out to generate at the biodiversity level. Particularly good examples can be found in thematic and impact funds that have developed highly innovative specialized portfolios, although there are still few cases.

Biodiversity is an issue of special concern for the European Union and the United Nations, which are increasingly focused on creating robust ecosystems (soil regeneration) and preventing human activities from doing further damage.

Europe forces sustainable funds to quantify:

- Activities that negatively affect areas where biodiversity is vulnerable:

The Share of Investments in Society investees with sites/operations located in or near biodiversity-sensitive areas where the activities of these Society adversely affect. the lower the percentage, the better.

In addition, Europe recommends the quantification of the following indicators:

- Investment in companies that produce chemicals:

The share of investment in companies producing paints, pesticides, enamels, inks or other chemicals related to agriculture. - Land degradation, desertification, soil sealing:

The share of investment in companies whose activities cause land degradation, desertification or soil sealing. - Investment in farms without sustainable land/agriculture practices.:

The share of investments in farms without sustainable land/agriculture practices or policies.

- Investment in companies without sustainable practices in the oceans/sea:

The share of investments in companies without sustainable practices or policies in the oceans/sea. - Deforestation:

The share of investment in companies without a policy to address deforestation. - Artificial terrain:

The proportion of area not covered by vegetation (areas that have not been covered by vegetation in the ground, as well as on roofs, terraces, and walls) to the total area of plots in all activities. - Natural species and protected areas:

The share of investments in companies whose operations have a negative impact on threatened species.

Here you will find in-depth materials for understanding the important role of biodiversity on our Planet :

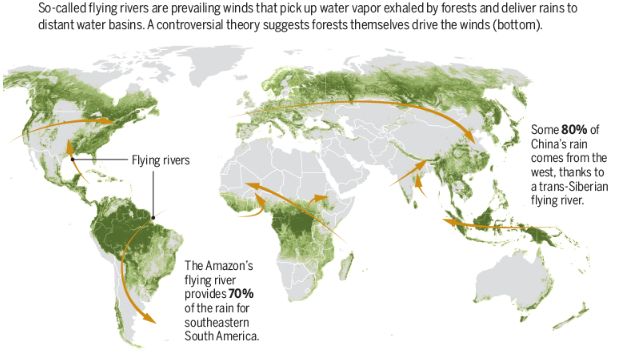

How forests contribute to the rain cycle:

For better reading of the data, please rotate your device.

The 5 Most Profitable Sustainable Equity Funds Intent on Preserving Biodiversity :

The 5 Most Profitable Sustainable Equity Funds Intent on Preserving Biodiversity :

| type_name_en | Classification | instrument_id | isin | masterisin | Fund | Currency | ESGAP | class_type | Theme | Cod_impact | Area | ESG Intensity | Performance | RIschio | Performance 6 months | Performance 1 year | Performance 3 years |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equity | Sectoral Equities - Precious Metals | 39.219 | LU1989765984 | LU1989765984 | cpr invest global gold mines | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 0 | 84,58 | 167,31 | 296,32 | |

| Equity | Sectoral Equities - Precious Metals | 84.102 | FR0007374145 | FR0007374145 | LCL ACTIONS OR MONDE | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 0 | 84,40 | 166,76 | 293,13 | |

| Equity | Spain equities | 20.297 | LU0346389850 | LU0346389850 | fidelity funds iberia | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 3 | 16,29 | 35,40 | 108,37 | |

| Equity | International Emerging Markets Equities | 81.395 | LU2577110138 | LU2577110138 | Fidelity Funds Sustainable EM Ex China | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 3 | 42,84 | 58,32 | 91,72 | |

| Equity | Emerging Markets Equity - Latin America | 15.654 | LU0201576070 | LU0201576070 | amundi funds latin america equity | USD | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 1 | 37,71 | 52,88 | 75,01 | |

| Equity | International Emerging Markets Equities | 81.639 | LU2386147164 | LU2386147164 | Amundi Funds Emerging Markets Equity ESG Improvers | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 3 | 35,23 | 46,15 | 77,52 | |

| Equity | International Emerging Markets Equities | 17.159 | LU0248177411 | LU0248177411 | schroder isf emerging markets | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 2 | 32,94 | 42,31 | 65,54 | |

| Equity | International Emerging Markets Equities - EUR Hedged | 29.689 | LU0947062542 | LU0947062542 | schroder isf emerging markets - hedged | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 2 | 31,71 | 54,60 | 66,66 | |

| Equity | International Emerging Markets Equities - EUR Hedged | 26.243 | LU0690087043 | LU0690087043 | Lombard Odier Funds Emerging High Conviction - Hedged | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 2 | 29,01 | 49,00 | 68,65 | |

| Equity | Japan equities | 21.011 | LU0370789561 | LU0370789561 | fidelity funds japan advantage | JPY | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 1 | 28,45 | 42,87 | 83,67 |

The 5 Most Profitable Sustainable Bond Funds Intent on Preserving Biodiversity :

The 5 Most Profitable Sustainable Bond Funds Intent on Preserving Biodiversity :

| type_name_en | Classification | instrument_id | isin | masterisin | Fund | Currency | ESGAP | class_type | Theme | Cod_impact | Area | ESG Intensity | Performance | RIschio | Performance 6 months | Performance 1 year | Performance 3 years |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bond | Asia Pacific Bonds - Convertibles | 21.532 | LU0394778749 | LU0394778749 | lombard odier funds convertible bond asia | USD | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 1 | 15,48 | 20,41 | 49,97 | |

| Bond | Maturity Bonds | 51.031 | LU1025014462 | LU1025014462 | fidelity funds target tm 2045 euro | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 0 | 11,06 | 8,07 | 44,33 | |

| Bond | Maturity Bonds | 51.024 | LU0393655021 | LU0393655021 | fidelity funds target tm 2035 euro | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 0 | 11,05 | 8,09 | 43,46 | |

| Bond | Maturity Bonds | 51.025 | LU0393655294 | LU0393655294 | fidelity funds target tm 2040 euro | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 0 | 11,04 | 8,09 | 44,10 | |

| Bond | Maturity Bonds | 51.032 | LU1025014892 | LU1025014892 | fidelity funds target tm 2050 euro | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 0 | 11,02 | 8,08 | 44,30 | |

| Bond | Absolute Return Bond Vol 5-7.5 | 16.074 | LU0218201217 | LU0218201217 | schroder isf emerging markets debt abs. ret. | GBP | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 1 | 8,23 | 9,45 | 34,45 | |

| Bond | Maturity Bonds | 51.023 | LU0393654990 | LU0393654990 | fidelity funds target tm 2030 euro | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 1 | 6,79 | 5,82 | 28,49 | |

| Bond | International Convertible Bonds | 62.718 | LU1495639384 | LU1495639384 | swisscanto (lu) bond responsible coco | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 2 | 4,00 | 7,14 | 26,66 | |

| Bond | International Convertible Bonds | 89.100 | LU2040497344 | LU2040497344 | JSS IF CoCo Bond | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 2 | 3,26 | 6,93 | 34,46 | |

| Bond | Subordinated Bonds | 51.283 | LU1883334515 | LU1883334515 | amundi funds global subordinated bond | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 3 | 3,06 | 6,61 | 38,11 |

The 5 most profitable sustainable ETFs intent on preserving biodiversity :

The 5 most profitable sustainable ETFs intent on preserving biodiversity :

| type_name_en | Classification | instrument_id | isin | masterisin | Fund | Currency | ESGAP | class_type | Theme | Cod_impact | Area | ESG Intensity | Performance | RIschio | Performance 6 months | Performance 1 year | Performance 3 years |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equity | International Equity - EUR Hedged | 71.646 | IE00BJQRDP39 | IE00BJQRDP39 | invesco quantitative strategies esg global equity multi-factor ucits etf - Hedged | EUR | 5 | Exchange Traded Fund | SDGE1 | Environment | 5 | 5 | 3 | 14,21 | 21,36 | 75,44 | |

| Equity | European equities | 71.600 | IE00BHZPJ783 | IE00BHZPJ783 | ishares msci europe esg enhanced ucits etf | EUR | 5 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 4 | 16,25 | 14,06 | 45,36 | |

| Equity | European equities | 71.595 | IE00BJQRDL90 | IE00BJQRDL90 | invesco msci europe esg screened ucits etf | EUR | 5 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 4 | 15,45 | 13,35 | 45,66 | |

| Equity | Shareholders Europe Ex UK | 75.316 | IE00BMDBMW94 | IE00BMDBMW94 | invesco msci europe ex uk esg universal screened ucits etf | EUR | 4 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 3 | 14,70 | 12,87 | 45,82 | |

| Equity | European equities | 73.002 | IE00BFNM3D14 | IE00BFNM3D14 | ishares msci europe esg screened ucits etf | EUR | 5 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 4 | 14,66 | 13,21 | 47,77 | |

| Equity | International Equity | 71.645 | IE00BJQRDN15 | IE00BJQRDN15 | invesco quantitative strategies esg global equity multi-factor ucits etf | USD | 4 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 2 | 14,04 | 11,36 | 65,98 | |

| Equity | Euro equities | 71.598 | IE00BHZPJ015 | IE00BHZPJ015 | ishares msci emu esg enhanced ucits etf | EUR | 4 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 3 | 13,77 | 15,12 | 49,17 | |

| Equity | Euro equities | 68.824 | IE00BFNM3B99 | IE00BFNM3B99 | ishares msci emu esg screened ucits etf | EUR | 4 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 2 | 13,23 | 14,49 | 50,29 | |

| Equity | International Equity | 85.310 | IE000TG1LGI4 | IE000TG1LGI4 | UBS (Irl) MSCI World ESG Leaders UCITS ETF | USD | 4 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 2 | 9,76 | 8,36 | 56,16 | |

| Equity | International Equity - EUR Hedged | 86.846 | IE0009W21NT4 | IE0009W21NT4 | UBS (Irl) ETF MSCI World ESG Leaders UCITS ETF - Hedged | EUR | 4 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 3 | 9,64 | 17,88 | 63,89 |

The 5 most profitable sustainable thematic funds intent on preserving biodiversity :

The 5 most profitable sustainable thematic funds intent on preserving biodiversity :

| type_name_en | Classification | Theme | instrument_id | isin | masterisin | Fund | Currency | ESGAP | class_type | Cod_impact | Area | ESG Intensity | Performance | Risk | Performance 6 months | Performance 1 year | Performance 3 years |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equity | International Equity | Disruption | 73.308 | LU1897556350 | LU1897556350 | Groupama Global Disruption | EUR | 3 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 1 | 18,32 | 18,83 | 78,27 |

| Equity | Sectoral Equities - Technology | Big data and artificial intelligence | 77.014 | LU2446850484 | LU2446850484 | Amundi Solutions Italy Artificial Intelligence Action Project. | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 3 | 17,29 | 21,45 | 58,35 |

| Equity | Sectoral Equities - Technology | Robotics | 42.309 | BE0176735018 | BE0176735018 | belfius equities robotics & innovative technology | USD | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 1 | 16,70 | 16,50 | 62,67 |

| Equity | Sectoral Equities - Technology | Disruption | 74.308 | LU1752457405 | LU1752457405 | jss if sustainable equity tech disruptors | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 1 | 16,42 | 16,18 | 85,23 |

| Equity | International Equity | Circular Economy | 74.243 | LU2092759021 | LU2092759021 | robecosam circular economy equities | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 1 | 15,36 | 18,06 | 56,46 |

| Equity | International Equity - EUR Hedged | Circular Economy | 89.403 | LU2529316510 | LU2529316510 | robecosam circular economy equities - Hedged | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 1 | 14,50 | 24,64 | 56,16 |

| Equity | Sectoral Equities - Technology | Digitization | 81.432 | LU2527298876 | LU2527298876 | Invesco Metaverse | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 2 | 12,91 | 15,83 | 108,65 |

| Equity | International Equity | Equality and inclusion | 70.500 | LU1939215312 | LU1939215312 | Nordea 1 Global Diversity Engagement | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 2 | 11,36 | 9,93 | 58,39 |

| Equity | International Equity | Equality and inclusion | 89.145 | LU1939214851 | LU1939214851 | Nordea 1 Global Gender Diversity | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 2 | 11,24 | 9,68 | 57,34 |

| Equity | Sectoral Equities - New Energies | Alternative energy | 72.451 | LU2145462722 | LU2145462722 | robecosam smart energy equities | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 3 | 1 | 37,67 | 49,65 | 60,56 |