Learn

about

sustainability

Discover

your

preferences

Explore

sustainable

investments

Enhance

your

investments

Check

your

portfolio

Take action

with

awareness

Protect

biodiversity

biodiversity

How Can I Take Action?

Biodiversity can be defined as the wealth of life on earth: the millions of plants, animals and microorganisms, the genes they contain, and the complex ecosystems they make up in the biosphere.

Biodiversity is assessed by theabundance and interactions among the different forms of life that inhabit our Planet. Diversity at the genetic, species and ecosystem levels is usually studied.

Preserving biodiversity means monitoring and taking action to preserve and strengthen natural ecosystems to ensure that they function properly so that nature continues to provide us with food and water, and continues to act as a barrier to the spread of pathogens and reduce the concentration of CO2 in the atmosphere.

Human activities are the main contributors, directly or indirectly, to the degradation of biodiversity, and sustainability goals aim to restore a balance throughvoluntary action to protect ecosystems and endangered animal and plant species

Common fund goals can be combined with climate goals (acting on forests to curb CO2 emissions), or focused on innovative development plans for sustainable agriculture or in other forms of projects related to the development of qualitative forms of coexistence between humans and nature.

Sustainable investors use several management strategies :

The Exclusion Approach: Many funds approach the issue by excluding Society that do harm to the environment, such as through unsustainable agricultural or real estate practices, or that are causing deforestation of primary forests.

The Thematic Approach: some funds invest exclusively in Society and in projects that have biodiversity at the heart of their economic activities (research, agriculture, forest management). Sometimes biodiversity is part of the activities of so-called thematic funds dedicated to climate or the environment. Rarely does it become part of activities of generalist funds.

The Normative Approach: funds make particular reference to the work of the UN, the UN Convention on Biodiversity, and the Sustainable Development Goals, particularly the Earth and Water Life Actions, and the Genetically Modified Organisms conventions. Nonprofit institutions and academics continuously monitor the situation and provide support and analysis on the ground.

Best practices-impact investing: impact funds have developed evolved systems for monitoring results and work with researchers, academics, and entrepreneurs to implement innovative, high-impact projects.

We use about 100 criteria to calculate the importance of the biodiversity issue in the activities of mutual funds in our universe.

At the level of ESG Screening, we see a large number of exclusion strategies (commodity extraction, deforestation, fur, GMOs), particularly among generalist funds and ETFs. Several Society have developed a management policy that takes into accountESG Risk related to biodiversity, and act accordingly. Others also take into account theImpact they go out to generate at the biodiversity level. Particularly good examples can be found in thematic and impact funds that have developed highly innovative specialized portfolios, although there are still few cases.

Biodiversity is an issue of special concern for the European Union and the United Nations, which are increasingly focused on creating robust ecosystems (soil regeneration) and preventing human activities from doing further damage.

Europe forces sustainable funds to quantify:

- Activities that negatively affect areas where biodiversity is vulnerable:

The Share of Investments in Society investees with sites/operations located in or near biodiversity-sensitive areas where the activities of these Society adversely affect. the lower the percentage, the better.

In addition, Europe recommends the quantification of the following indicators:

- Investment in companies that produce chemicals:

The share of investment in companies producing paints, pesticides, enamels, inks or other chemicals related to agriculture. - Land degradation, desertification, soil sealing:

The share of investment in companies whose activities cause land degradation, desertification or soil sealing. - Investment in farms without sustainable land/agriculture practices.:

The share of investments in farms without sustainable land/agriculture practices or policies.

- Investment in companies without sustainable practices in the oceans/sea:

The share of investments in companies without sustainable practices or policies in the oceans/sea. - Deforestation:

The share of investment in companies without a policy to address deforestation. - Artificial terrain:

The proportion of area not covered by vegetation (areas that have not been covered by vegetation in the ground, as well as on roofs, terraces, and walls) to the total area of plots in all activities. - Natural species and protected areas:

The share of investments in companies whose operations have a negative impact on threatened species.

Here you will find in-depth materials for understanding the important role of biodiversity on our Planet :

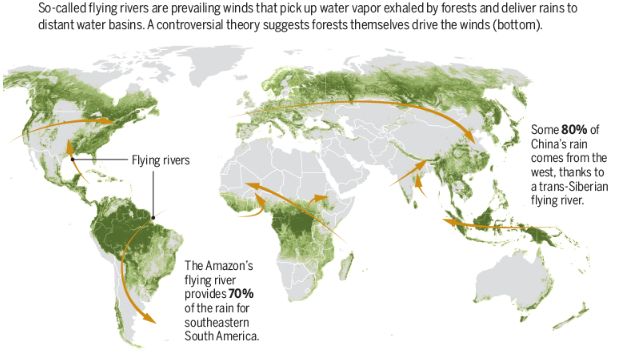

How forests contribute to the rain cycle:

For better reading of the data, please rotate your device.

The 5 Most Profitable Sustainable Equity Funds Intent on Preserving Biodiversity :

The 5 Most Profitable Sustainable Equity Funds Intent on Preserving Biodiversity :

| type_name_en | Classification | instrument_id | isin | masterisin | Fund | Currency | ESGAP | class_type | Theme | Cod_impact | Area | ESG Intensity | Performance | RIschio | Performance 6 months | Performance 1 year | Performance 3 years |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equity | Sectoral Equities - Banking & Finance | 79.607 | LU1876459303 | LU1876459303 | Axiom European Banks Equity | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 1 | 36,88 | 51,86 | 209,48 | |

| Equity | Italian equities | 19.378 | LU0318940342 | LU0318940342 | fidelity funds italy | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 1 | 23,59 | 24,79 | 86,02 | |

| Equity | Spain equities | 20.297 | LU0346389850 | LU0346389850 | fidelity funds iberia | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 4 | 21,58 | 23,80 | 81,93 | |

| Equity | Italian equities | 12.344 | LU0106239527 | LU0106239527 | schroder isf italian equity | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 1 | 20,03 | 33,35 | 91,74 | |

| Equity | Japan equities | 42.950 | IE00B2430N18 | IE00B2430N18 | axa IM japan equity alpha | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 1 | 7,73 | 8,99 | 76,44 | |

| Equity | International Equity - Growth | 45.425 | LU1218204631 | LU1218204631 | invesco global opportunities | USD | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 1 | 3,42 | 12,44 | 87,31 | |

| Equity | Germany equities | 20.290 | LU0346388530 | LU0346388530 | fidelity funds germany | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 2 | 18,83 | 30,85 | 65,84 | |

| Equity | Euro equities | 2.957 | BE0948779229 | BE0948779229 | DPAM INVEST b equities emu behavioral value | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 2 | 17,99 | 18,83 | 51,46 | |

| Equity | Italian equities | 10.264 | IT0004253800 | IT0004253800 | amundi dividend italy | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 1 | 15,51 | 14,48 | 57,21 | |

| Equity | Euro equities | 76.352 | FR0013185055 | FR0013185055 | ODDO BHF M?tropole Euro SRI | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 2 | 14,80 | 13,33 | 54,33 |

The 5 Most Profitable Sustainable Bond Funds Intent on Preserving Biodiversity :

The 5 Most Profitable Sustainable Bond Funds Intent on Preserving Biodiversity :

| type_name_en | Classification | instrument_id | isin | masterisin | Fund | Currency | ESGAP | class_type | Theme | Cod_impact | Area | ESG Intensity | Performance | RIschio | Performance 6 months | Performance 1 year | Performance 3 years |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bond | Euro Bonds - High Yield | 28.724 | LU0849400030 | LU0849400030 | schroder isf euro high yield | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 2 | 3,07 | 9,23 | 30,32 | |

| Bond | Euro Bonds - High Yield | 15.497 | LU0195952261 | LU0195952261 | franklin templeton euro high yield | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 3 | 2,94 | 7,96 | 28,84 | |

| Bond | Euro Bonds - High Yield | 23.210 | LU0496389221 | LU0496389221 | AB I Sustainable Euro High Yield Portfolio | USD | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 0 | 2,73 | 7,85 | 25,91 | |

| Bond | Euro Bonds - High Yield | 27.966 | LU0823381016 | LU0823381016 | bnp paribas funds bond euro high yield | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 2 | 2,69 | 8,90 | 28,30 | |

| Bond | Euro Bonds - Medium Term | 16.325 | LU0227128450 | LU0227128450 | axa wf euro 5-7 | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 3 | 2,58 | 7,14 | 21,49 | |

| Bond | Euro Bonds - Corporate | 73.318 | FR0013217999 | FR0013217999 | echiquier altarocca hybrid bonds | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 3 | 2,32 | 7,01 | 22,58 | |

| Bond | Euro Bonds - High Yield | 12.911 | LU0119109980 | LU0119109980 | amundi funds euro high yield bond | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 3 | 2,29 | 7,78 | 25,02 | |

| Bond | Euro Bonds - High Yield | 63.647 | LU0115288721 | LU0115288721 | oddo bhf euro high yield bond | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 3 | 2,18 | 6,70 | 27,30 | |

| Bond | Euro Bonds - High Yield | 29.922 | LU0966249640 | LU0966249640 | dpam l bonds eur corporate high yield | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 3 | 2,10 | 7,30 | 26,19 | |

| Bond | Euro Bonds - High Yield | 77.119 | LU2244386483 | LU2244386483 | BNP Paribas Easy ? High Yield SRI Fossil Free Track | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 5 | 3 | 2,09 | 7,08 | 23,70 |

The 5 most profitable sustainable ETFs intent on preserving biodiversity :

The 5 most profitable sustainable ETFs intent on preserving biodiversity :

| type_name_en | Classification | instrument_id | isin | masterisin | Fund | Currency | ESGAP | class_type | Theme | Cod_impact | Area | ESG Intensity | Performance | RIschio | Performance 6 months | Performance 1 year | Performance 3 years |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equity | Euro equities | 68.824 | IE00BFNM3B99 | IE00BFNM3B99 | ishares msci emu esg screened ucits etf | EUR | 4 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 2 | 11,83 | 10,78 | 53,80 | |

| Equity | Euro equities | 71.598 | IE00BHZPJ015 | IE00BHZPJ015 | ishares msci emu esg enhanced ucits etf | EUR | 4 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 2 | 11,10 | 10,79 | 52,16 | |

| Equity | Japan equities | 60.100 | IE00BYVJRQ85 | IE00BYVJRQ85 | ishares sustainable msci japan sri ucits etf | EUR | 3 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 1 | 4,53 | 7,72 | 61,88 | |

| Equity | International Equity | 71.646 | IE00BJQRDP39 | IE00BJQRDP39 | invesco quantitative strategies esg global equity multi-factor ucits etf | EUR | 5 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 3 | 4,08 | 10,28 | 60,48 | |

| Equity | International Equity | 71.743 | IE00BFNM3J75 | IE00BFNM3J75 | ishares msci world esg screened ucits etf | USD | 3 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 1 | -5,01 | 5,19 | 46,08 | |

| Equity | U.S. equities | 75.188 | IE000COQKPO9 | IE000COQKPO9 | invesco nasdaq-100 esg ucits etf | USD | 2 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 0 | -6,67 | 3,38 | 73,10 | |

| Equity | U.S. equities | 73.006 | IE00BFNM3G45 | IE00BFNM3G45 | ishares msci usa esg screened ucits etf | USD | 4 | Exchange Traded Fund | SDGE1 | Environment | 5 | 4 | 2 | -8,39 | 4,54 | 50,22 | |

| Equity | European equities | 62.325 | LU1603795458 | LU1603795458 | indexiq factors sustainable europe equity | EUR | 4 | Exchange Traded Fund | SDGE1 | Environment | 5 | 3 | 4 | 11,79 | 12,37 | 42,23 | |

| Equity | Euro equities | 62.287 | LU1602144575 | LU1602144575 | amundi etf msci emu esg leaders select ucits etf | EUR | 5 | Exchange Traded Fund | SDGE1 | Environment | 5 | 3 | 3 | 8,94 | 6,20 | 42,06 | |

| Equity | European equities | 75.307 | IE00BKSBGT50 | IE00BKSBGT50 | fidelity sustainable research enhanced europe equity ucits etf | EUR | 4 | Exchange Traded Fund | SDGE1 | Environment | 5 | 3 | 4 | 8,79 | 6,51 | 37,03 |

The 5 most profitable sustainable thematic funds intent on preserving biodiversity :

The 5 most profitable sustainable thematic funds intent on preserving biodiversity :

| type_name_en | Classification | Theme | instrument_id | isin | masterisin | Fund | Currency | ESGAP | class_type | Cod_impact | Area | ESG Intensity | Performance | Risk | Performance 6 months | Performance 1 year | Performance 3 years |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equity | European equities | Climate action | 69.313 | LU1670717674 | LU1670717674 | M&G (Lux) Pan European Sustainable Paris Aligned | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 3 | 8,25 | 7,72 | 52,22 |

| Equity | Sectoral Equities - Technology | Digitization | 81.355 | LU2429106300 | LU2429106300 | AXA WF Metaverse | USD | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 1 | 2,11 | 10,54 | 56,10 |

| Equity | International Equity | Circular Economy | 74.243 | LU2092759021 | LU2092759021 | robecosam circular economy equities | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 2 | 0,91 | 7,68 | 46,36 |

| Equity | Sectoral Equities - Technology | Big data and artificial intelligence | 69.360 | LU1819479939 | LU1819479939 | echiquier artificial intelligence | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 1 | 0,06 | 16,29 | 74,52 |

| Equity | Sectoral Equities - Water | Water | 78.071 | LU2001709976 | LU2001709976 | Variopartner Tareno Global Water Solutions | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 4 | -0,73 | 3,67 | 41,80 |

| Equity | International Equity - Growth | Disruption | 70.960 | LU1910165999 | LU1910165999 | schroder isf global disruption | USD | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 0 | -5,61 | 1,45 | 48,37 |

| Equity | Sectoral Equities - Technology | Robotics | 39.821 | LU1279333329 | LU1279333329 | pictet robotics | USD | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 4 | 1 | -5,89 | 1,56 | 62,00 |

| Equity | Euro equities | Climate action | 74.917 | FR0013369832 | FR0013369832 | fideas smart for clim action eurozone | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 3 | 2 | 16,77 | 17,34 | |

| Equity | International Equity | SDG | 78.264 | LU2051778681 | LU2051778681 | NEF ETHICAL GLOBAL TRENDS SDG | EUR | 4 | Open-end mutual funds | SDGE1 | Environment | 5 | 3 | 3 | 13,95 | 19,59 | 44,16 |

| Equity | Sectoral Equity - Climate & Environment | Climate action | 74.814 | LU2116701777 | LU2116701777 | dnca invest beyond climate | EUR | 5 | Open-end mutual funds | SDGE1 | Environment | 5 | 3 | 4 | 13,60 | 8,43 | 20,75 |