Robo4Advisor, the expert system for savings professionals, gets a makeover :

They are now available online :

- Of the expanded ranges of financial instruments

- New Investment Universes related to French, Italian and Luxembourg financial products

- our New model wallets

Robo4Advisor is designed to create profitable and sustainable Portfolio allocations, monitor their quality, and tailor them to each client's situation.

and if you want to link our roboadvisory functions with your management or administrative system :

- activate our ESG and Financial Data form to receive our financial and ESG analysis automatically

- or automatically imports into Robo4advisor to monitor the quality of Client positions on a daily basis.

Thus, you will check daily compliance with the risk profile and sustainability preferences of all your clients.

An expanded range of financial instruments

Cryptocurrencies, Certificates, Commodities ... the investment world is changing rapidly, and Financial advice needs to update promptly :

Robo4Advisor has been amplified to accompany the advisor who wants to easily identify the best investment solutions.

- Mutual Funds and ETFs

- Open Pension Funds

- Separate Insurance Accounts

- Exchange Traded Commodities and Cryptocurrencies

- Certificates

- International listed stocks

- Real estate funds

Our new model R4A wallets.

Robo4advisor is the only tool to offer advisors dozens of performing Portfolio allocations developed by our team of investment experts.

There are 29 R4A model portfolios made available for users to quickly work out allocations for their clients that are in line with their goals :

- the 6 R4A base portfolios are strategic Portfolio allocations to equity markets (developed countries, emerging markets, sector allocation) and bonds (Euro Area, Global High Yield and Investment Grade).

- the 23 R4A Master Portfolios are diversified portfolios optimized by artificial intelligence according to various algorithms - from a financial and ESG perspective.

And to buy you some time, you will find some portfolios by network created based on the contents of the offerings of 120 Italian, French and Luxembourg insurers and/or network banks.

We'll give you various allocations built to outperform the market :

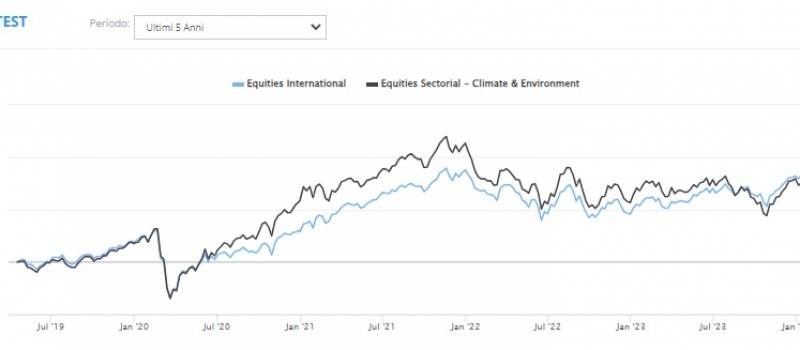

- 2 Total Return equity allocations, one classic and one ESG

- 1 Euro bond total return allocation

- 3 allocations by risk level

Take us along with you with the new R4A Data Modules.

we will give you more information

and a customized demo

Have you ever thought of calculating a rating on your clients' Portfolio ? Today you can apply the powerful calculation functions of Robo4Advisor directly in your management system with our Data solutions :

- Link your administrative system with R4A and receive weekly all financial and ESG ratings of analyzed Client portfolios

- They will be competed against all mutual funds on the market and you will receive a weekly personalized rating !

You can also automatically take R4A's financial and ESG analysis data and bring it into a management application and make it available to your clients on the Web.

For better reading of the data, please rotate your device.